The United States’ Commodity Futures Trading Commission (CFTC) alleges that two firms in 2008 engaged in illegal oil futures speculation. It has taken about three years, but finally some justice will come from this (albeit limited). If only the same charges can be brought against firms that speculated on food commodities will we see retribution for those that were directly affected by the violence that swept the world during the 2007-2008 global food riots.

The United States’ Commodity Futures Trading Commission (CFTC) alleges that two firms in 2008 engaged in illegal oil futures speculation. It has taken about three years, but finally some justice will come from this (albeit limited). If only the same charges can be brought against firms that speculated on food commodities will we see retribution for those that were directly affected by the violence that swept the world during the 2007-2008 global food riots.

Upward Bound

Gasoline prices in the United States have been breaking into new inflation-unadjusted territory lately. I pulled some data from the United States’ Energy Information Administration (EIA) that suggests a not so comfortable summer this year. Lets take a quick look at one of EIA’s graphs:

http://eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=EMM_EPM0U_PTE_NUS_DPG&f=W

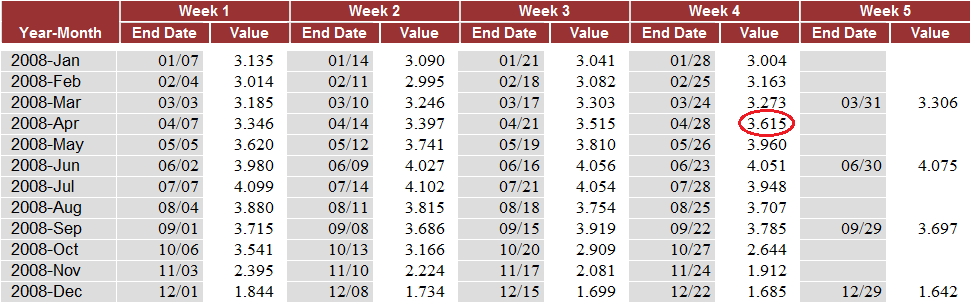

If we peer into the actual numerical data, we can observe that average all-conventional U.S. retail gasoline prices over the fourth week of April 2011 (ending April 25) had a mean price of $3.867.

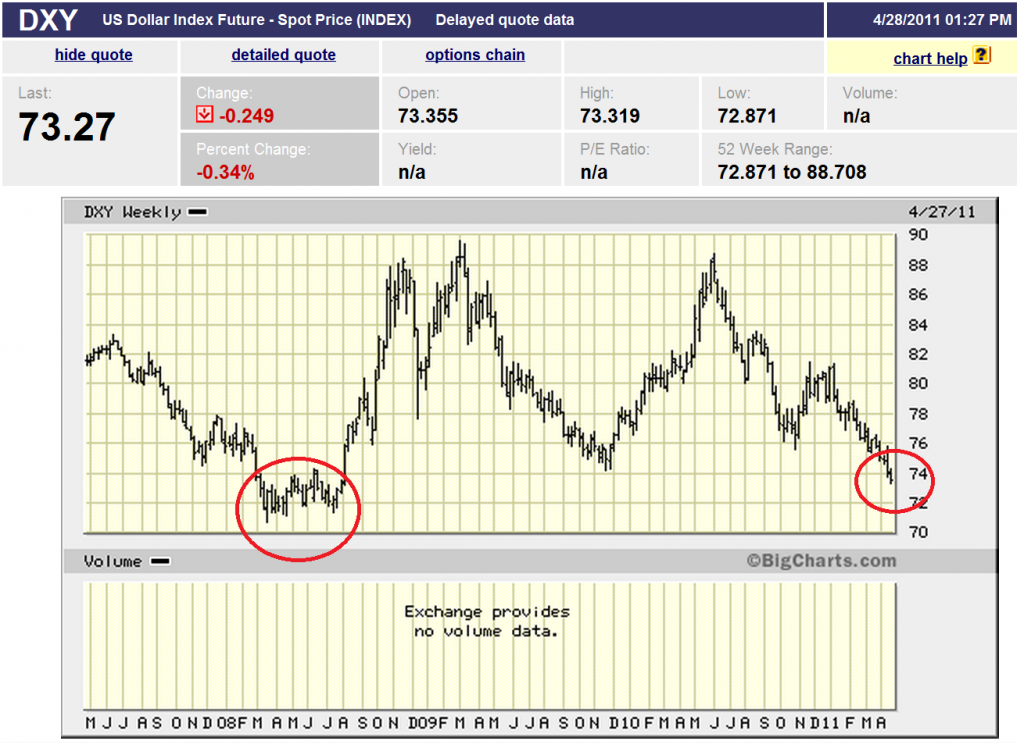

Since the value of the dollar right now is close to what the value of the dollar was during the depths of the liquidity crisis in 2008, I would argue that this is a valid enough reason to compare U.S. gasoline price trends today to price trends in the first half of 2008. The value of the dollar in international currency markets seems to negatively correlate enough with gasoline prices to be used as a complementary metric of the other (I’m too lazy to do the statistics for that right now).

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=dxy&insttype=&freq=2&show=&time=11&x=0&y=0

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=dxy&insttype=&freq=2&show=&time=11&x=0&y=0

The U.S. Dollar Index tracks a basket of international currencies against the U.S. dollar. Since quite a bit of oil is exchanged for dollars in commodities markets, it might be useful to also note that the value of the dollar right now is only 1.3% more than the value of the dollar during April of 2008, only marginally worth more since the recession. Initially, I was led to think that gas prices were perceived by Americans to be high simply because the dollar was weaker which would mean that it would cost more in dollars to purchase a barrel of oil that would drive up the input costs to produce a gallon of gasoline. But gasoline prices year-over-year from April 2008 to April 2011 have gone up by 6.97%–far outpacing the 1.3% rise in the dollar’s worth (which currently has a downward trajectory) as well as outpacing the 2.5% inflation rate from 2008 to 2011.

Although building forecasting models from somewhat causal relationships between currencies and goods is more complex than this, we’ve at least ruled out the “weak dollar hypothesis.” If we run with the assumption that the U.S. Dollar Futures Index and gasoline prices are negatively correlated anyways, we might get a tiny sense of where gasoline prices in the United States could potentially head in a worst-case, recession style situation:

The circled table cell shows that we paid during the fourth week of April 2008 an average price of $3.615. Notice also the HUGE plummet in prices to $1.685 in December 2008. I suspect that this was due to the U.S. Federal Reserve’s 1st round of quantitative easing maneuvers (QE1) that began in November 2008.

If we look at the rate of change in month-over-month retail gasoline prices of the fourth week of each month from January-July 2008, prices went up 5.38% on average for each month in that series. If we assume the same average rate of change in month-over-month prices of the fourth week of January until the expected mid-July peak in 2011, we can potentially see gasoline prices hitting a weekly average of $4.294 this summer and then retreating afterwards. But of course there are other factors that could contribute to how prices accelerate or decelerate from now until the end of summer. The Middle East and North Africa is going to be on everyone’s minds (even though there is no reason it should, but that’s an entirely separate conversation) as well as hurricane season in the Gulf Coast.

An Energy Crisis of the Third-World Kind

There has been an international media fanfare circling the nuclear disaster at the Fukushima Daiichi plant in Japan over the last month since the Tohoku earthquake and tsunami, but not all energy disaster coverage is created equal. Perhaps an equal amount of attention has been given to Libya and its oil. But I fear that there are other more neglected disasters which continue to get the silent treatment from the international community.

When Americans or the Western world think of the country of Somalia, what is evoked in their minds? …warlords, famine, piracy, Black Hawk Down? What about nuclear toxic waste?

I first heard about the dumping of toxic and radioactive wastes by European companies off the shores of Somalia from musician K’naan (internationally famous for writing the 2010 World Cup Anthem, “Wavin’ Flag”) as a precursor to the piracy movement in his country, but I merely brushed it aside as a rumor. However, recently, I found a post from a Minnesotan blogger who confirms K’naan’s claims via multiple official independent sources.

Some folks say that silence in the face of violence is often worse than the original crime itself. But some crimes don’t even scratch the surface of the mounting unspoken injustices of the world. As is historically the case, these environmental crimes seem to always implicate the international scramble–heinous or not–for the world’s energy and resources.

The Hubris of Empire

So it seems that once again, brilliant network and computer engineers have found a back door into some of the largest multinational corporations:

“The names and e-mails of customers of Citigroup Inc and other large U.S. companies, as well as College Board students, were exposed in a massive and growing data breach after a computer hacker penetrated online marketer Epsilon.”

http://www.reuters.com/article/2011/04/04/us-citi-capitalone-data-idUSTRE7321PI20110404

Internet security has always maintained an elusive veil of protection. As much as we would like to think that the mapping of our digital selves onto cyberspace remains within our full control (especially with the advent of social networking services such as Facebook, Twitter, LinkedIn), I predict that such breaches of internet security will continue to be on the rise. [1]

With respect to energy security, the most recent string of network hack-ins at major financial and energy corporations over the last couple of months [2][3] present an interesting problem to the wave of so-called “smart grid” initiatives that intend to provide more automation of our electric power systems. The current VPNs and telemetry systems that facilitate automatic generation control (AGC) to keep the United States’ electricity grid secure have historically been remarkably reliable; however, the additional layers of telecommunications infrastructure being proposed for the grid will present more opportunity for similar breaches we’ve seen at financial and oil firms. One can envision distributed denial of service (DDoS) attacks orchestrated by a nation state with enough wherewithal on the future smart grid (several hackers at major banks have been traced to China DNS and IP addresses) by shutting down commercial systems to gain economic advantages.

Only time will dictate the fate of nations.

See also

[1] U.S. Computer Emergency Readiness Team. http://www.us-cert.gov/reading_room/index.html

[2] “Chinese hackers targeted Morgan Stanley in 2009.” http://www.guardian.co.uk/technology/2011/mar/01/morgan-stanley-chinese-hackers (1 Mar 2011).

[3] “Data theft attacks besiege oil industry.” http://news.cnet.com/8301-30685_3-20031291-264.html?part=rss&tag=feed&subj=News-Security (2 Feb 2011),

i4Energy Web Seminar Series

The i4Energy seminar series is a weekly presentation series hosted by CITRIS (Center for Information Technology in the Interest of Society) at the Sutardja Dai Hall on the University of California, Berkeley campus. All of the presentations are open to the public and host various energy experts of all fields from policy, technology, and industry.

Every week I’ll be posting a new web seminar. So stay tuned!

This presentation is about 2 years old, but highlights the future progress of our electricity grid. Chris Knudsen from PG&E discusses his company’s role in developing the smart grid.

Iraqi Oil and George Soros

I’ve always respected billionaire George Soros for his sound investment strategies and his overall cool, rational demeanor when it comes to discussing markets; but this news just puts a foul stench on his pocket book:

“Last month, after years of wrangling between Kurdistan’s regional capital Erbil and Baghdad over revenues, exports finally started to flow. Foreign investors — among them Russian oligarchs, a British mercenary boss, U.S. politicians, a former diplomat, and funds controlled by the billionaire investor George Soros — who have sunk $5 billion into Kurdistan’s oil fields, hope they will finally begin to enjoy the rewards.”

via http://www.reuters.com/article/2011/03/10/us-kurdistan-oil-idUSTRE72921820110310

Thou shalt not steal

The U.S. treasury has frozen around $USD 32 billion in Libyan assets, meanwhile Republican congressional leaders and the Obama administration are considering to directly support anti-Qaddafi forces. Some sources even say that they are coordinating international allies such as Saudi Arabia by urging them to militarily support the rebels. Sounds like someone’s placing bets.

You, the Banks, and Energy

If you aren’t already sick of hearing the nauseating cacophony of words such as “collateralized debt obligations,” “credit default swaps,” “mortgage-backed securities,” and other financial industry newspeak, then I encourage you to watch Chad Beck’s and Adam Bolt’s Inside Job (2010). The film, which recently won an Oscar for best 2010 documentary film, exquisitely pieces together the myriad confluence of events and people who were instrumental in orchestrating the 2007-2008 Global Financial Crisis. I don’t intend to make you revisit any traumatizing feelings you may have had as the economy plunged into the depths of the crisis, but I do hope that by watching the film you and I can hopefully connect on an emotional level and make you feel exactly how I felt while watching it: PISSED-THE-FUCK-OFF!!

I’ve always asked myself if my anger was ever justified. Looking back on my life, my parents have always been hardworking American citizens since they set foot in this country. My father grew up on the streets of Bangalore, India, and had the luck there of meeting a family from the United States who offered to take him to this country. My mother moved from a small province in the Philippines to work as a nurse in this country. Since the earliest days of their existence, they have always worked hard and honestly for the things they needed, much less the things they wanted. They’ve seen it all, done it all. And for them to have witnessed thousands of dollars of their hard-earned money disappear from their retirement accounts, to have been systemically discriminated from receiving small business loans on the basis of their credit scores, and to have fallen for the joke of the American dream, I can’t help but wonder how they go on to live so calmly and peacefully.

On the converse side of things, I look at what has been happening recently in North Africa and in the Middle East and see millions of embattled victims of institutionalized repression exercising their collective option to no longer take shit. What amazes me so much, however, is not that these uprisings are even happening but that foreign policy experts and esteemed global financiers seemed to have completely missed what was socially, politically, and culturally brewing in these regions for decades. And now many who had financial stakes in these regions are looking at the news and scratching their heads. No one predicted this. It’s no news to these stakeholders that autocratic rulers have had control of countries like Morocco, Libya, Egypt, Tunisia, etc. for decades. In fact some of these regimes like Mubarak’s were even recipients of tens of billions of dollars of Western financial and military backing and even praised for bringing “stability” to these regions – which we all know really means protecting investments.

I don’t want to make equal comparisons between countries in these regions to our country. Basic freedoms which don’t exist in these countries are protected in European and North American democracies (at least in legal theory). And we don’t face as much government-sanctioned corruption (I would like to believe) and physical repression (unless you’re poor, brown, or both) to ever warrant any citizen of this country to set one’s self on fire in protest or to riot by the hoards. But then again, if you take a short trip across the Mediterranean Sea to Europe you’ll see just as much anger manifested in civil disobedience in countries like Greece, Italy, France, and the United Kingdom. But these Europeans are angry for very different reasons.

The Eurozone crisis, however, is actually very similar to ours in the United States. Our European counterparts have been protesting against further equity erosion, inadequate financial reform, government sell-off of public services to private institutions (like education, worker’s pension, and healthcare), and consolidation of wealth into the hands of the few since the outset of the global financial crisis. Ironically, the North African and Middle Eastern countries in outright revolt right now actually saw their real GDPs rise in 2009 whereas North American and Western European nation-states all saw their GDPs fall. So I’m led to believe there is a certain parallel: North Africans were being robbed of their human dignity by their political leaders, and us Westerners were being robbed of our hard-earned cash by our economic leaders.

Then again, I still can’t seem to grasp the fact that most young-adult Europeans who are my age care enough about the direction of their public institutions to actually stand up against their misguided leaders, and yet most young-adult Americans who are my age are continuing to idle by entranced by the false pursuit of success we see and hear on our web browsers, headphones, and flat screens.

Government spending is in dire straits these days, but the most recent congressional budget assault on Obama’s landmark Consumer Financial Protection Bureau is just another example of the misguided leadership we have in this country. The citizenry complained just enough about being robbed by the banks that the administration created the Bureau headed by Prof. Elizabeth Warren, but now bank-backed political leaders are threatening to gut the Bureau on the grounds that federal spending is bad spending… and not a single one of us flinching. I think we might regret allowing the bank lobbies to do this.

I’ve also noticed that folks are complaining about gas prices again on Facebook. It seems to be the only commodity that middle-class youth and young adults care about these days. And so as the situation in North Africa and the Middle East continues to spook the banks and the energy industry, I can’t help but play the wishfully thinking devil’s advocate. I’m usually a person that never wishes for ill-tidings, but the one ill-tiding I’m wishing for is more volatile fossil fuel prices in the United States. I’m hoping people in this country will eventually wake the fuck up when that happens. I’m hoping that the big investment banks lose billions off gambling on volatile oil, commodity prices, and weapons sales. And I’m hoping this government will be wise enough, if such were to happen, to NOT give-in to the bankers. I don’t mean to be misanthropic. I do hope that all those living on the margins of our society receive enough transfer payments to ride out food and fuel inflation. But I think that once our economic and political problems are–in the words of my friend Oz, “right in our fucking faces”– will we ever be angry enough to do anything about them. Millions around the world have been rioting already due to soaring energy and food prices since the first global food crisis. And now global ministers fear a second round of global riots over food and commodity prices. I don’t think U.S. hegemony will shield us from these global fluctuations forever.

In the meantime, I’m going to emulate my parents and be cool, calm and peaceful. Yet I can’t help but feel sometimes that quiet, honest living gets no respect.

Solar Under The Sun

Solar II attendee shows Solar I attendees the technical aspects of the solar-powered water system

Last week I spent some time in Little Rock, AR, attending the Solar Under the Sun (SUTS) training session at Camp Ferncliff. SUTS trains and equips volunteers to be build effective and successful community-oriented solar-powered water purification systems. As a crash course on solar PV installation I was quite impressed with the level of expertise demon- strated by the teachers as well as their commitment to helping those most in need in the world. Nearly all of the trainers had experience in-country working on solar projects or had professional engineering degrees. SUTS is a volunteer-run organization of Presbyterian Church members from Arkansas, Texas, Oklahoma, and Louisiana and is partnered with other international programs such as Living Waters for the World and the Haiti Education Foundation. And although I’m not the most religious or church-going individual, I was thoroughly inspired by the dedication and commitment of everyone who attended.

From Sept. 9 until Sept. 12, attendees engaged in community building and teamwork exercises, cultural sensitivity workshops, technical training, and partnership modeling. The entire session was broken into two groups of attendees: Solar I (which focused on the community partnership models) and Solar II (which focused on the technical side of designing and building the systems). I bunched with the Solar II folks. In addition to learning the “blackboard” essentials of solar PV installation and the mechanics of water filtration, we built disconnector boxes (i.e. the heart of the system) that would be sent to Haiti. The hands-on learning was a huge plus for me.

Solar II attendees put together disconnector boxes from scratch

(From left to right) Tim, George, Grimsley, and Charles putting some last-minute touches to their disconnector box

Solar II team showing off the product of their labor

Camp Ferncliff had many amenities and the staff was very hospitable. Each training session cost about $500 and covers room, boarding, showers, linens, and three meals a day. The camp even had a solar-powered buggy that you could ride!

On-site solar-powered shuttle

I felt a bit out of place when I first arrived since I figured I might be the youngest of the crowd and maybe the only brown kid. But there was one person actually from Haiti who had been sponsored by SUTS and the Haiti Education Foundation to attend, and another woman from Kenya studying disaster management at Oklahoma State. All together, everyone was welcoming enough to break the ice.

Solar II trainer Jerry Goode wrapping up the camp during the final plenary

By the end of the camp, other than feeling drawn by a higher sense of urgency and duty to assisting those living in the direst of conditions in the world, I felt humbled by a renewed sense of purpose being more thoroughly immersed in nature. As the world turns, we as human beings are merely a footnote in the annals of nature’s history, yet recognizing our interconnectedness with the world, to one another, and with those living on the margins of global society are fundamental steps toward working for a future in which humankind can live in balance with the world and with each other.

You can find more pics from the training session on my photobucket site.

starting afresh

This site is a continuation of an earlier, more amateurish project which I am glad to finally put to rest. The content of this new page will be bent more towards my research interests at school and in general so that this could eventually become a space for serious dialogue and discussion. Whatever is to become of this pursuit is up to you, the reader, lest I have any at all.